In recent times, financial markets have shown increased fluctuations, a consequence of changes in the policies of major central banks and evolving economic data.

This article aims to explore the complexities and nuances of current market conditions, focusing on the economic growth, inflation trends, and contrasting monetary policies in the U.S. and Eurozone. We aim to offer a comprehensive review and forward-looking insights that are crucial for investors and traders navigating these turbulent times.

Economic Outlook: Shifts in U.S. and Eurozone Markets

It is clear that the calm observed in March was short-lived. Initially aligning with the Federal Reserve’s guidance, the market has become less optimistic about future rate cuts, reigniting concerns about a persistent “higher for longer” interest rate environment. This shift in sentiment has further highlighted the diverging paths between the United States and the Eurozone.

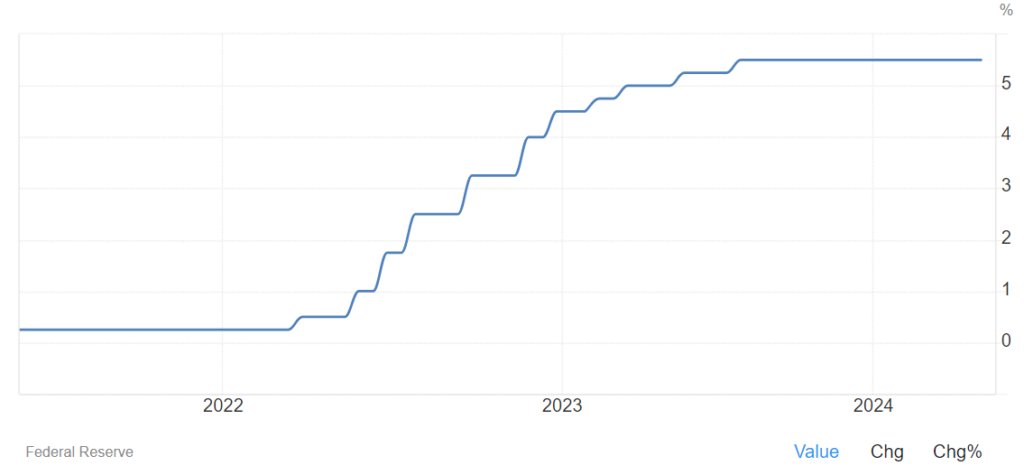

As a reminder, the current FED funds rates are the following and they remained unchanged yesterday:

And here are traders’ expectations changes over 3 months:

U.S. Economic Slowdown: A Closer Look

Is the U.S. economy finally showing signs of slowing down? This seems to be the case, as first quarter annualized growth figures for 2024 stand at 1.6%, significantly below the expected 2.5%. Despite this, inflation remains stubbornly high at 3.5%, a 0.3% increase from the previous month, with core inflation stable at 3.8%. However, beneath the dominant inflation narrative, a worrying trend in the employment market is emerging, which many are overlooking. At first glance, the creation of 303,000 jobs in April suggests a resilient economy. Yet, a closer examination reveals a decrease in full-time employment and an increase in part-time roles, with a significant number of households holding multiple jobs—reaching historic highs. Moreover, many of the newly created jobs are in precarious sectors, which are vulnerable in an economic downturn.

U.S GDP Growth Rate

Eurozone Gains Clarity

In contrast, the Eurozone’s path appears clearer. The first quarter showed a growth rebound to 0.4%, with an annual inflation rate steady at 2.4% and core inflation decreasing by 20 basis points to 2.7%. ECB President Christine Lagarde hinted at an almost certain 25 basis point rate cut starting in June, after maintaining the ECB’s main refinancing rate at 4% this month.

Eurozone interest rates

ECB Sets Scene for Rate Reduction Amid Declining Euro Area Inflation

Central Bank Divergence

While the ECB can take pride in its recent progress, the same cannot be said for its American counterpart. With the market now expecting three rate cuts from the ECB by year-end, confidence in the Federal Reserve’s future actions is waning, with only one anticipated rate cut before November—a stark contrast to the seven cuts expected at the beginning of the year. Driven by either excessive optimism or pessimism, the U.S. market struggles to find the right balance, exaggerating each new economic data point. This issue is exacerbated by the Fed’s overly “data-dependent” approach, which has trapped it in a reactive rather than proactive stance. This has been more or less confirmed by Jerome Powell, FED’s chairman, stating they will move accordingly depending on the data coming out.

U.S Inflation Rate

Volatility makes a comeback

In this context, volatility has made a striking return in the bond markets, as evidenced by the sharp rise in the MOVE Index this month. The U.S. 10-year bond yield surged by 48 basis points in April, retracing 75% of the drop seen in the last two months of 2023. Its European counterpart rose by a more modest 30 basis points to close at 2.59% at the end of April.

U.S 10Y Note Bond Yield

These significant movements have led to a -2.53% decrease in the U.S. Aggregate Bond Index for the month, marking its eighth worst monthly performance in the last two decades. In contrast, the European index fell by -1.47%, reminiscent of the challenging months from the past two years.

Credit Spread* Observations

As for credit spreads, there have been no significant changes to report. They experienced a slight increase over the month but closed at stable levels compared to the previous month.

*A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. Typically, it’s used to measure the risk premium investors demand to hold a bond with a higher risk of default compared to a risk-free or more secure bond.

For example, the credit spread between a corporate bond and a government bond (often considered close to risk-free) of the same maturity can indicate the additional yield investors require as compensation for taking on the extra risk associated with the corporate bond. Wider spreads generally suggest a perception of higher risk, while narrower spreads indicate a perception of lower risk.

Credit spreads can vary widely across different sectors and ratings. They are influenced by a variety of factors including economic conditions, interest rate expectations, and specific issuer risks. They are a critical aspect of fixed income investing, providing insight into market sentiment and risk tolerance.

Thanks for reading 👋

Cryptorise Group

Join us on Twitter – Instagram – LinkedIn